INSIGHTS

Scaling The Hydrogen Economy: Can We Look To Solar As A Realistic Growth Trajectory For Electrolyzer Build Out?

Hydrogen is positioned to play a key role in the energy transition by facilitating global decarbonization efforts

Hydrogen is positioned to play a key role in the energy transition by facilitating global decarbonization efforts, particularly in industries that are difficult to electrify. However, like any emerging technology, hydrogen faces growing pains and its fair share of challenges. As energy sector leaders, policy makers, and scientists work together to face these challenges, looking to the past can sometimes provide useful scaffoldings for thought leadership. One such apparatus is the build out of solar and other renewables in the early 2000s. This thought exercise is not meant to invite a direct comparison between solar and electrolyzers. Rather, it simply uses the realized market growth from the solar industry and allows for exploratory considerations as we attempt to begin the same process with electrolyzers and hydrogen infrastructure. While the decarbonization potential of green hydrogen is currently limited by a lack of supply, significant progress is being made in project announcement and developments. 100+ gigawatts (GW) in recent years have put upward pressure on electrolyzer demand, in turn increasing electrolyzer manufacturing capacity. According to the International Energy Agency (IEA), global electrolyzer manufacturing capacity increased 25% to nearly 11GW in 2022. Decarbonization targets are nothing short of aggressive and recently the IEA’s Net Zero Emissions by 2050 (NZE) Scenario, showed upwards of 550GW of total installed electrolyzer capacity would be needed by 2030. This is just one of several projections for needed capacity globally, which begins the exercise and begs the question: How does that target compare against possible growth of installed electrolyzer capacity?

Renewable energy faced similar questions and doubts when the industry was still in the very early stages of development. By looking at the speed at which renewables (with particular attention to solar) have been deployed over the last decade, we have a potential proxy for how electrolyzer capacity build out could unfold.

Electrolyzers: How High and How Far

Solar panels and electrolyzers are alike in that they are modular in nature and can be manufactured in high volumes using current technologies, which supports their use across installations of all sizes. They also present relatively few challenges and complexities when it comes to logistics, which is not typically the case with other clean energy technologies like wind turbines.

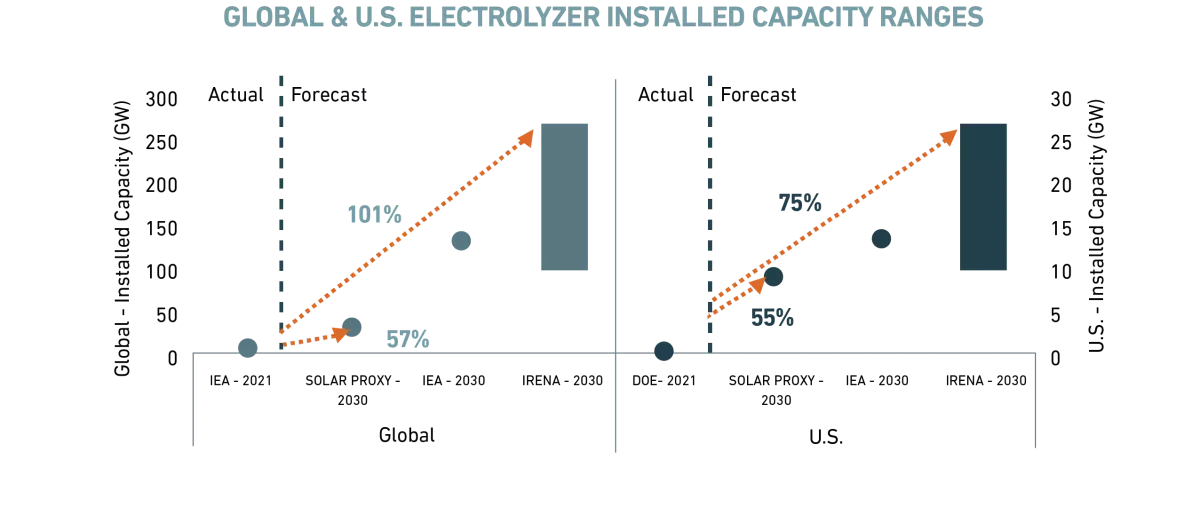

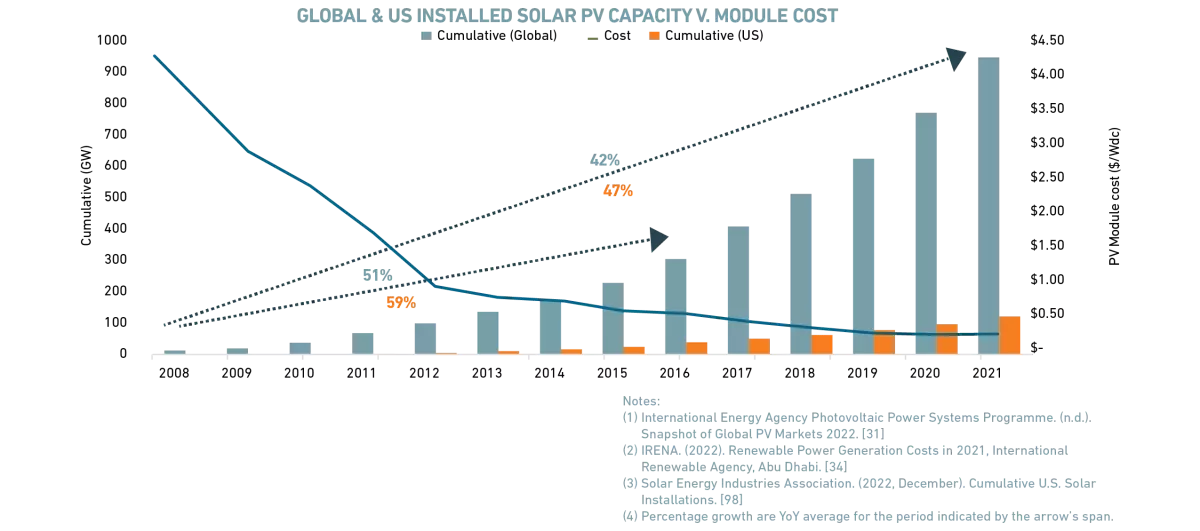

From 2008 - 2021, installed solar experienced a 42% average annual growth rate (AAGR) globally. In the eight years spanning from 2008 - 2016, the AAGR was 51%. Based on data from the IEA, the total installed electrolyzer capacity globally in 2021 was around 500MW. If we applied the same rate of growth as solar (51%), total installed electrolyzer capacity would reach only ~11GW by 2030.

An argument could be made that the inherent versatility of hydrogen (and its wide range of end-uses) give it even better growth prospects than solar had during its early phase of scaling. However, electrolyzers will likely not benefit from residential deployments as solar did. Taking a look at natural gas consumption for 2022 can help demonstrate the scale of hydrogen potential outside of the residential market. Total natural gas consumption was ~32 trillion cubic feet (Tcf) according to the US Energy Information Administration (EIA) representing the electric power (38%), industrial (32%), residential (15%), commercial (11%) and transportation (4%) sectors. While hydrogen won’t replace 100% of the natural gas market, the point is, there is large potential beyond residential applications. When looking at the US electrical consumption of nearly 4 trillion kWh, the residential sector accounted for 38% or 1.51 trillion kWh, based upon EIA data for 2022. Given the opportunity size outside of residential, it is reasonable to anticipate the versatility of hydrogen will outweigh the detriment of not accessing residential markets.

“The modularity of electrolyzers is an important attribute that will support scaling the hydrogen economy, as end-users today have vastly different capacity needs. While some developers leveraging incentives from the public sector need hundreds of electrolyzers for utility-scale installations, others require significantly fewer units for small-scale plants or even pilot demonstrations. Their inherent flexibility supports all ends of the demand spectrum and will ultimately be key to accelerating adoption.”

- Kent Rockaway, Senior VP Commercial Leader U.S. and Canada, Mitsubishi Power

According to their 2022 report, the IEA forecasts total installed capacity for electrolyzers to reach 134GW by 2030, an 86% AAGR from 2021. Similarly, the International Renewable Energy Agency (IRENA) predicts 2030 electrolyzer installed capacity to reach 100GW (conservative estimate). Under a more aggressive scenario, installed capacity reaches 270GW by 2030. These figures represent an ~80% and ~100% AAGR versus the current installed capacity of ~500MW and far outpace the rate that solar experienced early on.

Figure 1

Looking specifically at the U.S., from 2008 – 2016, solar saw a 59% AAGR. According to the U.S. Department of Energy (DOE), the total installed capacity of electrolyzers in the U.S. as of 2021 was 172MW. Following the same approach as above for the global calculation (but using the U.S. solar market AAGR as a proxy), the installed capacity of electrolyzers in the U.S. by 2030 would be ~9GW. However, there is an opportunity to outperform this historical proxy against the global landscape, which can be seized if the US can expand manufacturing footprint and deploy projects at scale across industry verticals. It is here we can stop and consider what this would imply for the rest of the world. If the United States is positioned as a market leader, the world can not only look to the US to address many of the “first mover” challenges that come with energy shifts like this but also be the solution for continued electrolyzer deployments. Hydrogen generally is a prime opportunity for the US to lead global markets in the energy sector.

Taking a slightly different approach using the data in Figure 2 below, the U.S. has represented (on average) roughly 10% of the global installed capacity of solar since 2008. Translating that percentage to IEA and IRENA electrolyzer forecasts would put the U.S. electrolyzer installed base between 10GW (IEA forecast) and 27GW (IRENA forecast) by 2030.

From a cost perspective, both the IEA and IRENA growth scenarios estimate electrolyzer CAPEX in the $350-$450/kW range by 2030, which represents a 55 - 80% reduction versus 2020, depending on starting equipment costs ($1,000-$1,800/kW). This is broadly in line with the 84% cost reduction that solar achieved during the period spanning from 2008 – 2016.

Figure 2

There has been growth in the development pipeline of green hydrogen projects and manufacturing facilities since the original IEA forecast referenced above. The latest IEA forecasts as of July 2023, show the installed electrolyzer capacity could reach between 170-365 GW by 2030. These newer figures would equate to an AAGR of ~92% and ~107% from the 2021 data, versus the original 86% and 100%, respectively. This upward revision further illustrates the growth potential of electrolyzers.

The Importance of Policy

Whether these figures are achieved depends on many factors, particularly developments in regulations and policy. It is clear from the spectrum of forecasts and projections that these spaces are some of the most influential of actual outcome.

Much of the renewable market growth early on can be attributed to government incentives: the solar industry through an Investment Tax Credit (ITC), and the wind industry through a Production Tax Credit (PTC). These provisions played a crucial role in driving progress and to this day serve as a tailwind for the industry.

The Inflation Reduction Act (IRA) has now made many of the same credits available for clean hydrogen production in the United States, particularly in the Section 45V PTC.

Additionally, the hydrogen industry stands to benefit indirectly from other credits for carbon-free power generation, energy storage, and carbon sequestration. With the focus on creating zero- or low-carbon hydrogen, the source of electricity becomes a critical factor and creates a strong tie between clean power and energy storage.

The IRA created and strengthened several tax credits for renewable energy, nuclear power generation, and storage, as well as a consolidation of renewables into a “technology neutral” bucket starting in 2025.

This is a foundational change to the U.S. tax code, as it establishes a technology-agnostic approach that encourages investments in the best low-carbon solution given the requirements of the application or facility. In doing so, it effectively levels the playing field among technologies, such as solar, wind, batteries, hydrogen, and carbon capture.

“The IRA is a transformative piece of legislation and will be a significant tailwind to solar growth over the next decade. In addition to expanding and extending the availability of existing incentives, the industry will benefit from new manufacturing tax credits which will drive U.S. domestic production capacity. Together, these provisions are expected to drive an additional 160 gigawatts (GW) of solar over the next decade when compared to a no-IRA scenario – with roughly $565 billion in new investment1."

- Bill Miller, Chief Executive Officer, Oriden

Overall, the IRA clearly defines the subsidy amounts and thresholds. However, the Treasury Department is continuing to develop and issue implementation guidance.

The draft guidance issued in December 2023 provides insight into the qualification requirements for the 45V tax credit. There are three key pillars: incrementality, temporal matching, and deliverability. As it currently stands, the rules are restrictive to enabling hydrogen projects at scale and of geographic diversity. The proposed framework may lend to electrolytic hydrogen being implemented in certain areas of the country, which could limit market access due to geographic concentration. Focus could also shift to hydrogen production via natural gas reformation with carbon capture and sequestration (CCS) or other technologies that are not as reliant on electricity.

Additionally, supply chain onshoring could be impacted, as China would retain production advantages over a smaller US manufacturing base.

A final decision from Treasury is not expected until later in 2024. The rules will have a significant impact on installed electrolyzer capacity growth and the general trajectory of the hydrogen economy over the coming years.

Looking to the Future

In summary, it is evident that hydrogen is on the cusp of becoming a major player in the energy transition. While there has been tremendous progress in maturing and scaling hydrogen technologies, broad adoption cannot come without supporting policies that incentivize growth on both the supply and demand side.

Much of the growth in wind and solar occurred prior to some of the broader decarbonization targets that exist today. While it could be argued that the IEA and IRENA forecasts for electrolyzer capacity are too aggressive, the versatility of hydrogen as an energy carrier, coupled with an increasing emphasis on decarbonization across industries, means that it would not be unreasonable to expect a growth rate that exceeds that of renewables. Given that the recent IEA installed capacity forecast was revised upwards from previous ones speaks to the tailwinds the hydrogen industry is experiencing and it would not be surprising to realize a growth rate beyond what the solar PV sector had accomplished.