INSIGHTS

Making The Hydrogen Revolution A Reality

To make the hydrogen revolution a reality, we need to double down on the progress already made

We are so close to achieving large-scale energy storage and power generation with clean hydrogen – yet so far away at the same time. As many in the energy industry know, clean hydrogen holds the promise of a zero-carbon fuel and affordable, long-duration storage. It can help decrease reliance on fossil fuels and ensure resource adequacy during the months when renewable supply is not able to meet demand. And it’s the right choice for our time, as we can use today’s curtailed wind and solar power to electrolyze water into green hydrogen as a means to utilize real-time oversupply.

But even for the most informed energy stakeholders, visualizing when our hydrogen future becomes a full-fledged reality is challenging. We need a bold, comprehensive plan to significantly expand the role of clean hydrogen, and the scale of necessary changes can affect our depth perception. Indeed, that future can still feel decades away.

What’s clear, however, is that many of the building blocks are already here. Electrolysis dates back more than 200 years, which was closely followed by the first hydrogen fuel cells producing energy through electrochemical means a few decades later. And a promising location to store hydrogen, underground salt caverns, has been used for natural gas since the 1960s.

Our speed to a hydrogen society depends on how much we advance and accelerate these existing building blocks – but we need to leverage the quick wins even as we take a long view on the progress.

The Quick Wins

It’s instructive to separate a hydrogen economy into its major components: production, storage, transportation, and usage. Transforming the entire value chain is a huge undertaking that requires public and private partnerships, likely decades in the making. But it’s easier to see meaningful near-term impact across these smaller pieces.

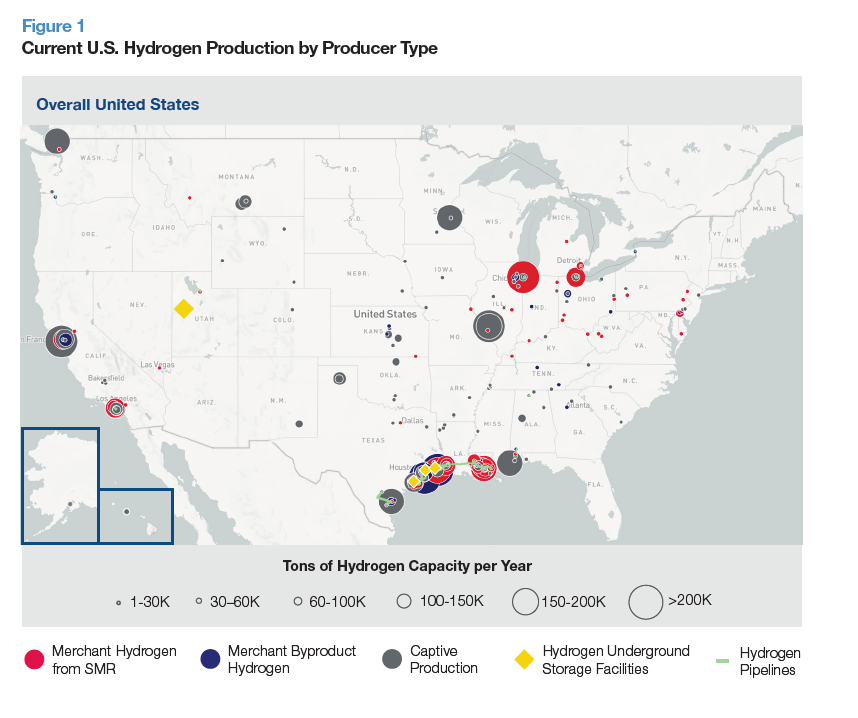

Let’s start with hydrogen production. According to government data compiled by the Energy Futures Initiative, the U.S. produced roughly 1.3 quadrillion BTUs of hydrogen on an energy basis in 2021, or about 1% of the country’s total energy production, largely from steam-methane reformation (SMR).

As of 2021, the U.S. had 257 dedicated hydrogen production facilities that produced just over 1% of the nation’s total energy. Source: Energy Futures Initiative

For renewables-powered electrolysis to overtake SMR as the predominant form of hydrogen production, electrolyzer manufacturing will need to expand orders of magnitude beyond current capacity. But the basic technology is already here. What is needed is additional manufacturing resources and innovation for automating the processes to realize increased production capacity.

Of course, that’s easier said than done. Getting suppliers to build gigawatts of electrolyzer capacity will require more than a handshake and a leap of faith. It will require contracts and capital. Pricing volatility – such as for shipping and commodities – can undermine even the most steadfast partnerships, especially in an industry where project financing requires price surety for months or years to come.

Then comes the broader supply chain. Much of the global manufacturing for electrolyzers occurs in China across a relatively small supplier base. As the U.S. tries to reestablish domestic supply chains, tariffs on imported Chinese goods could raise unit costs and introduce additional volatility.

Despite all this, higher-volume orders are moving ahead. In April 2022, Mitsubishi Power contracted to supply 40 hydrogen electrolyzers for a single facility. One of the largest such contracts to date, it could singlehandedly double the annual production levels of clean hydrogen worldwide. Similarly, Mitsubishi Heavy Industries, Mitsubishi Power’s parent company, has invested in hydrogen partners such as Electric Hydrogen and HydrogenPro to accelerate efficient, scalable electrolysis down the road.

Developments like these illustrate near-term wins, activities for which the pieces are already in place to succeed. Clean hydrogen is historically higher priced than hydrogen derived from natural gas, though fluctuations in gas prices can periodically shift that calculus. But with larger orders pumping revenue into the supply chain, economies of scale can emerge to drive down pricing for green hydrogen in the long term. And thanks to the U.S. government’s recently signed Inflation Reduction Act (IRA), clean hydrogen could become the cheapest form of hydrogen. (More on the IRA shortly.)

As with hydrogen production, hydrogen storage also has quick-win potential. Underground capacity is today’s best option, with salt caverns being especially promising thanks to their ease in mining and general impermeability. Significant potential exists for storage in available capacity near traditional infrastructure concentrations that used it for other fuels (along the U.S. Gulf Coast, for example) or in untapped salt reserves away from such infrastructure.

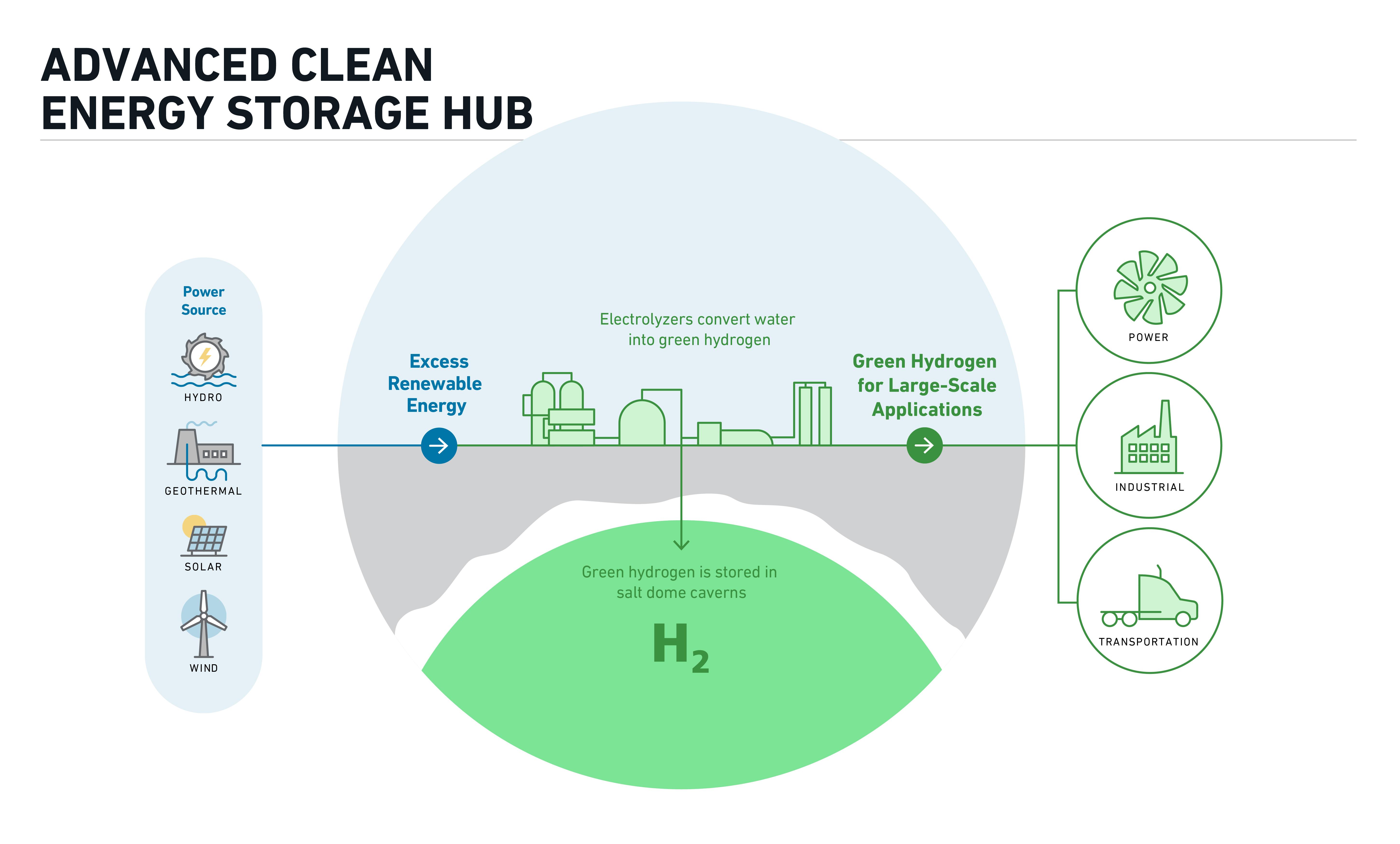

Currently, Mitsubishi Power is working with Chevron to create the Advanced Clean Energy Storage Hub in Delta, Utah (ACES Delta Hub). Expected to be the country’s largest hydrogen gas and storage hub, the ACES Delta Hub is under construction and on track to create some 9 million barrels of capacity in underground salt caverns. Each cavern is the height of the Empire State Building and these caverns have initial storage targets of 150 gigawatt-hours of clean energy. Hydrogen production will come by way of 220 megawatts of on-site alkaline electrolysis.

The ACES Delta Hub uses renewable energy to electrolyze water and store hydrogen in underground salt caverns. Source: Mitsubishi Power

Additional storage opportunity abounds. In 2021, Mitsubishi Power announced an alliance with Texas Brine Company to become the exclusive hydrogen storage partner through the company’s network of 13 salt holdings around the Gulf Coast, Virginia, and New York. Texas Brine solution-mines caverns to produce brine for the chlor-alkali and dry salt industry. Creating some 15 million barrels of capacity each year across all of its operations, it leases the resulting space to store crude oil, natural gas, and natural-gas liquids (NGLs). Now that roster will include hydrogen, too.

Powering ahead on hydrogen storage has ancillary benefits. Stakeholders will want to scale up all phases of green hydrogen projects – production, storage, transportation, and usage – in tandem to avoid an imbalance of resources and capital. But to an extent, large storage assets provide some buffer to building out transportation and usage components, for example. If demand for hydrogen does not match up perfectly with supply, caverns can serve the critical function of balancing and storing energy in the near term, enhancing reliability of the broader system.

Again, these are quick wins. We need to leverage them even as we take a longer view of progress.

The Longer View

Across the board, some aspects require a longer horizon. One is supply-chain development. Project activity increased after the IRA passed in 2022, but the timelines can run up against supply disruptions, especially if mitigations aren’t built in. Stakeholders will need years to develop a new domestic supply chain that’s cost-competitive and flexible enough to expand capacity with the market.

Then there’s the broader challenge of hydrogen usage. Hydrogen is already being used to generate electricity, but mostly in electrochemical fuel cells with nominal outputs. Power plants that use hydrogen fuel cells in the U.S. max out at just 25 megawatts of capacity per facility. By contrast, a natural-gas facility like Georgia Power’s Plant McDonough-Atkinson, just outside Atlanta, produces 2.52 gigawatts from three combined-cycle units. Moving green hydrogen into these domains – as a fuel, not a reactive element – is the key to realizing its full potential.

Broad implementation of large-scale power generation through hydrogen-fueled turbines would be a first for the energy sector, but it will require progressive technological advancements. As the Electric Power Research Institute recently noted, “getting to an H2 economy that provides H2 into gas turbines for low- or no-carbon emissions will require many technological advancements … [but] these advancements appear achievable because several OEMs and third-party vendors are working on viable options.”

The viability of those options may hinge on how well we can advance the energy infrastructure. As an example, the Intermountain Power Agency (IPA), will replace the plant’s two coal units with natural-gas-fed turbines that will run a hydrogen blend at the start of commercial operation in 2025. Similar power generation is under development elsewhere, with projects slated to come online by the late 2020s. As blending and turbine technologies progress, IPA will transition to 100% hydrogen by 2045.

The longer view may be decades out, but the glidepath can still drive decarbonization in the near term. Mitsubishi Power is supplying IPA’s replacement powertrains, which will cut carbon emissions by more than 75% versus the coal-fired units from the day they commence operations – all while supplying 840 megawatts of reliable energy. And when IPA transitions to 100% hydrogen fuel, carbon emissions will diminish entirely.

Similarly, Mitsubishi Power worked with Georgia Power and EPRI to validate a proof-of-concept fuel blend of hydrogen and natural gas at both partial and full loads on an M501G natural-gas turbine at McDonough-Atkinson. At a 20% hydrogen blend, the June 2022 test was the first to validate such levels on an advanced-class turbine in North America. It also reduced CO2 emissions by roughly 7% – again, proof that the journey toward tomorrow’s goals can still drive results today.

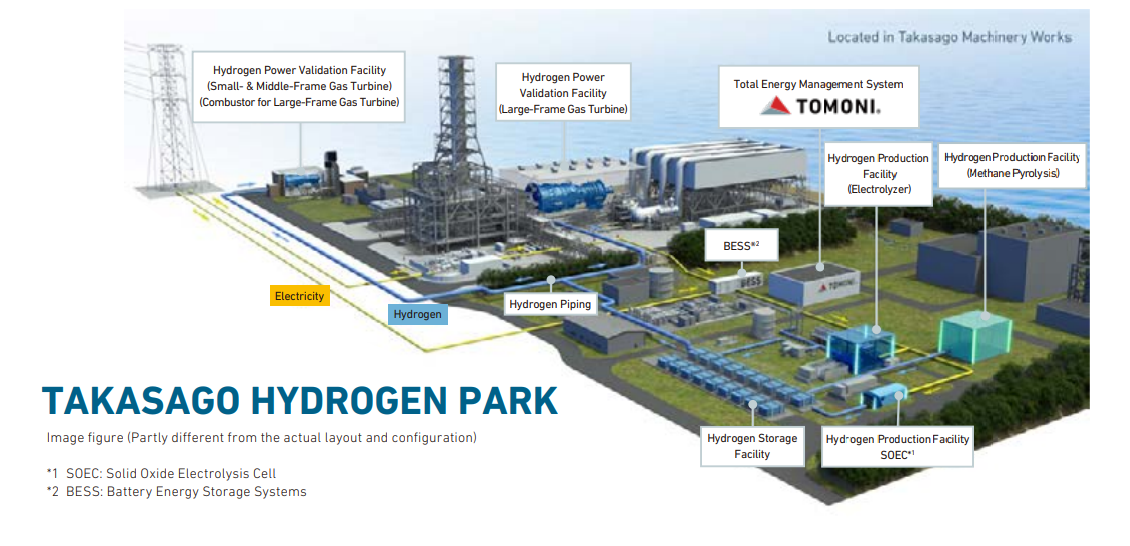

Validation is moving quickly, too. At its Takasago Machinery Works in southern Japan, Mitsubishi Heavy Industries (MHI) set up the world’s first center to validate hydrogen-related technologies. The new facility, Takasago Hydrogen Park, is adjacent to MHI’s longstanding combined-cycle plant used for long-term validation of gas turbine technology. Later this year, MHI will test the combustor for its large-frame M501JAC gas turbine on 100% hydrogen. And in early 2024, the company will validate its 40-megawatt H-25 gas turbine on 100% hydrogen fuel. The H-25 development will target commercialization by 2025.

Technology validation at MHI’s Hydrogen Park also includes production and storage technologies, including electrolysis and methane pyrolysis (the latter producing a solid-carbon byproduct that can be scavenged), as well as above-ground hydrogen storage and short-duration electricity storage. The facility dispatches power to the connected local grid, enabling MHI and Mitsubishi Power to learn under the same operating conditions as their customers. The company can also conduct validation tests on everything from the risk of flashback – a common phenomenon with hydrogen fuel – to NOx emissions and the fluctuations in combustion pressure for gas turbines.

Takasago Hydrogen Park can produce, store, and use hydrogen, with 100% H2 combustion expected to be validated in 2024 and commercialized in 2025. Source: Mitsubishi Power

It’s Still Early

What does the long view look like? It’s an embrace of public partnerships. For the ACES Delta Hub, Mitsubishi Power leveraged $504.4 million in loan guarantees from the U.S. Department of Energy. It’s also working with the public sector to clear up regulatory pain points. The IRA is an example of what works, having vastly improved the economics of producing green hydrogen for various applications – not just energy production but refining, transportation, energy exports, and other industrial applications. From changing the tax code to favor a technology-neutral approach to adding credits for hydrogen production and standalone energy-storage investments, the IRA will enable hydrogen to compete on a level playing field with other clean-energy technologies.

For these incentives to be most effective, we need other changes in the landscape. For example, the IRA provides a 10-year horizon for regulatory certainty, but the time it takes to get new projects permitted can cut significantly into that. The 118th U.S. Congress has already hit the ground running on permitting reform, a critical parallel if we want to fully realize the IRA’s benefits for clean-energy production. And we’ll need to see ongoing collaboration between government agencies to ensure consistent application of these tax provisions.

Finally, we need to adapt existing infrastructure to use hydrogen so we can efficiently use the capital that’s been invested into power generation over the past decades.

We’re still in the early stages of clean-hydrogen energy. We need a lot more work to happen across the board – more regulatory action, commercial projects, permitting reform, and scalable production. We need to spur more investment to drive down costs and accelerate research. In all of this, focusing on the long view is key even as we execute on the quick wins and achieve near-term impact. If enough stakeholders collaborate and join the movement, we can realize the enormous potential of Earth’s lightest molecule to help accelerate the transition to net zero.

*Article was originally published on H2Tech

At Mitsubishi Power we’re in a position to innovate in decarbonization, foster new strategic collaborations and commercialize new solutions – all of which will empower the world to reach net zero goals in 2040 or sooner.

Download Report